- Two approved Investment Zones, Liverpool City Region and South Yorkshire, outperforming the market year-on-year by 5 and 10% respectively

Analysis from property data and insight company Search Acumen shows approved Investment Zones in South Yorkshire and the Liverpool City region are outperforming the wider market in terms of commercial real estate transactions.

The latest data for H2 2023 (July to October 2023), when compared with the same period in 2022, shows that the South Yorkshire Investment Zone outperformed the market in terms of total transaction values by 5%, while the Liverpool City Zone outperformed by 10%.

The South Yorkshire and the Liverpool City Region Investment Zones were approved in July 2023. Subsequently, in November 2023 four more Investment Zones have been approved for West Yorkshire, Greater Manchester, the West Midlands and the East Midlands. More Investment Zones have been proposed across the UK including two Investment Zones in Wales, two in Scotland and one in Northern Ireland. In total 13 Investment Zones have been proposed by the Government.

Investment Zones were originally a brainchild of the Brexit campaign, though have now been passed through the hands of various administrations including short-lived premiership of Liz Truss, and more recently Rishi Sunak and the Chancellor Jeremy Hunt, who highlighted the policy in the 2023 Autumn Statement. Investment Zones are designated areas intended to spur economic growth and development by providing incentives and benefits to businesses and investors located within the zone’s boundaries. This is typically in the form of tax breaks, grants, subsidised infrastructure, streamlined regulatory processes, and other advantages. For example, rules within the zones allow for a lower tax burden and relaxed planning rules, while also reducing bureaucratic hurdles, aiming to incentivise business investment and expansion, commercial construction, and overall economic activity. The long-term goal of the areas is to economically transform distressed areas into vibrant hubs of commerce.

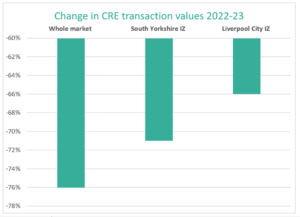

The statistics are within the context of a subdued market where total transaction value declined by 76% across the whole market (England and Wales) year on year. The total value of commercial transactions within the South Yorkshire Zone declined by -71% year on year, while the Liverpool City Region Zone declined by -66%.

Decreases in commercial activity within the South Yorkshire and Liverpool City Zones were dead-on the whole market benchmark at -64%. With volumes at benchmark but total transaction value outperforming within Investment Zones, this means that the average valuation for a commercial property within the South Yorkshire Zone performed 13% better than the whole market benchmark and the average valuation for the Liverpool City Region property performed 29% better than the benchmark.

“Now we have a few month’s data to go on, it looks like we’re seeing green shoots in terms of Investment Zone’s potential impact on local property markets. Of course, it is still early days, and this is within the context of an overall market which is being subdued significantly by high interest rates and inflation. But, the relative performance of Investment Zones versus the whole market could indicate they are having an early impact. It will be interesting to look at this data over the longer term as more Investment Zones come into operation to understand their real-world impact when set against the intended policy objectives.”

The data also showcases how far all the areas muted for Investment Zones could benefit from a boost to their local property market. Between 2017 and 2022, Investment Zone areas saw decreases in total real estate transaction values of between 13% and 44%.

| Region | 2017-2022 change in total transaction value |

| Liverpool City Region | -44% |

| Tees Valley | -38% |

| South Yorkshire | -35% |

| Greater Manchester | -19% |

| West Yorkshire | -18% |

| West Midlands | -18% |

| East Midlands | -15% |

| North East | -13% |

Search Acumen’s over 500 data layers grant lawyers and property professionals access to a huge depth of information that will help them to understand the real estate market across the UK, including within Investment Zones. This stands to help property companies and law firms as they look to progress deals over the coming years as Investment Zone policies come into operation and take effect, helping them better navigate the market in these areas as it changes.

Andy Sommerville

Andy Sommerville