The great conveyancing crunch: Property transactions double in a decade while conveyancing firms fall by 10%

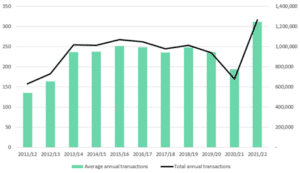

- Volume of annual property transactions have nearly doubled in a decade, from 714,000 in 2012 to over 1.3 million in 2022

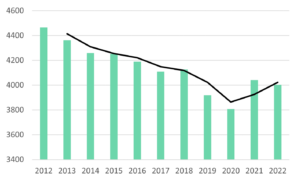

- Meanwhile, the volume of active conveyancing firms decreased by 10% in ten years

- To make up for this shortfall, average caseloads per firm have increased by 79%

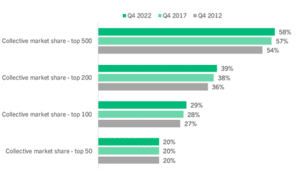

- The top 50 firms accounted for 20.5% of all transactions in Q4, compared with 19.3% a year earlier, in which 1% is equivalent to an extra 3,000 transactions at current levels of market activity

- Activity for firms outside the top 1,000 decreased, accounting for 24.6% of all transactions in Q4, compared with 25.9% a year earlier

- The top 200 firms were responsible for almost two in five transactions in Q4 (39.5%), compared with 36.5% ten years earlier in Q4 2012

It’s been a decade marked by unprecedented change, not least for the property market. Whilst average house prices in England have risen by 77%[1] since 2012, the latest data analysis from Search Acumen indicates a similar trajectory for annual property transaction volumes, almost doubling in a decade from 714,000, to over 1.3 million. This market boom has had a surprising effect on conveyancer volumes, in which active firms have incrementally decreased in number year-on-year, amounting to a 10% decline across the decade, leading to what can be described as the decades “great conveyancing crunch”.

According to its latest edition of the Conveyancing Market Tracker (CMT), Search Acumen says this incredible squeeze on solicitors is most abruptly felt in average caseloads, jumping by 79%[2] in ten years.

[1] Land Registry data comparing average house price in England in December 2022 at £315,119 vs December 2012 at £178,406.

[2] CMT data shows caseloads per firm in Q4 2012 averaged at 42.9 vs 77 in Q4 2022

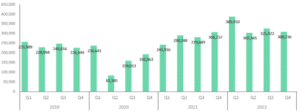

Looking at the average number of active firms in Q4 2022 (4,003), although numbers have stabilised to around pre-pandemic levels, they remain significantly down on the figure for Q4 2012 (4,465 active conveyancing firms). This represents a 10% decrease. Similarly, if you look at average firm numbers for those years, 2012 vs 2022, you also see a 10% decrease over the decade. There were, on average, 4464 active conveyancing firms in 2012 compared with only 4,035 in 2022.

[Graph 2: The number of active conveyancing firms has decreased by 10% over the decade, despite rebounding slightly since the pandemic]

The CMT shows that the top 200 firms were responsible for almost two in five transactions in Q4 (39.5%), compared with 36.5% ten years earlier in Q4 2012, showing that in a challenging market, it is the firms with deeper pockets allowing investment in tech as well as people, that are grabbing more market share.

Comparing year-on-year, the Tracker reports that the top 50 firms accounted for 20.5% of all transactions in Q4, compared with 19.3% in Q4 2021, in which 1% is equivalent to an extra 3,000 transactions at current levels of market activity. In comparison, activity for firms outside the top 1,000 decreased, accounting for 24.6% of all transactions in Q4, compared with 25.9% a year earlier.

[Graph 3: How the top firms are increasing their market share across the decade]

Property transactions – what’s next?

Whilst across the decade the market tracker shows transaction volumes have rampantly increased, looking at a more recent history the total volume of transactions across Q4 2022 falls roughly in line (+1%) with activity in the same period in 2021, indicating that things might be levelling off.

Similarly, the average number of quarterly transactions for all firms has decreased by 4% from the previous quarter, from 80 to 77, but is a similar figure when compared to a year ago when firms averaged 76 transactions in Q4 2021.

Indeed, according to Landmark Information Group[1], average residential transaction times are getting longer, taking an average of 132 days up from 82 days in 2007, and as consumer confidence hangs in the balance against an uncertain outlook for UK house prices, this may have an impact on transacting numbers for conveyancers in the months ahead. Search Acumen predicts things are unlikely to continue in this upward trajectory, as wider economic factors take the heat out of 2022’s boom.

Andy Sommerville, Director of Search Acumen, explains: “It’s been an unprecedented decade of pressure on the conveyancing sector, which culminated in the extreme levels of market activity during the pandemic and post pandemic period. With transaction volumes rising while firm numbers have consistently fallen, this has obviously created new commercial opportunities, but equally put huge strain on lawyers to meet the needs of the market through some of the most challenging years we’ve ever seen. We cannot underestimate how critical the UK conveyancing sector has been in keeping the property sector going, with lawyers going above and beyond, putting themselves at risk of burnout to meet the needs of their clients. Beyond conveyancing, the result of these efforts will have been a contribution to the UK economy that similarly cannot be overlooked or overstated.

“Looking back on the last ten years, we have to recognise the incredible contribution of conveyancers first and foremost. But, we equally need to understand that a decade of rapid technological advancement has built new resilience and put the sector in a position to thrive, even in the most challenging of contexts. Over the last ten years we have seen increasing adoption of digital solutions and processes, analytics, big data and transformative tech like AI and ML. Without these technologies the market’s performance, especially during the pandemic, might have been markedly different. Similarly, the ability of the sector to grow and deal with future challenges in the decade to come will depend on further technological innovation that supports the expertise and commitment of legal professionals, drives operational efficiencies, and reduces costs for firms and their clients.”

[Graph 4: Transaction volumes pre-and post-pandemic showing how the market recovered at pace, marking a boom year for 2022]