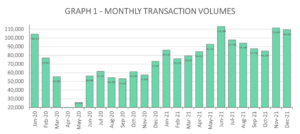

The final quarter of 2021 was the busiest on record for completed transactions logged with HM Land Registry, with over 100,000 transactions wrapped up in both November and December – another industry first.

Race to the end of the year sees transactions spike

The top 1,000 firms saw a 9% increase in quarterly activity, with 226,948 transactions registered in Q4 2021, compared to 209,019 the previous quarter. This represents an increase of 56% when compared with the previous year. These firms performed particularly well in November and December, recording over 80,000 transactions in consecutive months for the first time since tracking began in April 2011.

Those firms outside the top 1,000 equally performed well and recorded new heights of activity. In Q4 2021, a combined 79,289 transactions were logged, compared to 70,670 in Q3 and up by 69% from 46,957 in Q4 2020.

The monthly breakdown of transaction volumes shows the race for completing on properties before the year came to an end. Transactions were slightly higher in November than December – 111,637 compared to 109,505 – which can be expected as people’s minds turned to the year-end break and Covid-19 reared its head again.

However, transaction levels in Q4 2021 remained elevated in context of the pandemic period and were still 35% higher than in Q4 2019 before the pandemic first emerged.

Graph 1: Number of monthly transactions since Q1 2020

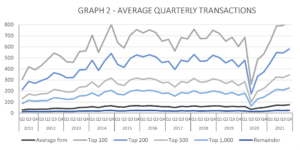

Activity reaches highest quarterly figure since records began

Analysis from Search Acumen shows that the average firm continued to operate at a frenetic rate to match buyer demand, undertaking 76 transactions on average for the quarter. This represents a 50% annual increase from the average of 50 transactions that were processed in Q4 2020 and is also the highest quarterly figure since records began. Furthermore, this figure has remained above 70 for the last three quarters, having never once exceeded 67 in the decade from Q2 2011 to Q1 2021 – indicating the sustained pressure that the conveyancing sector has experienced.

This experience was mirrored among the top 100 ranking firms, whose quarterly average for completed transactions reached a new high of 835 in Q4 2021.

Graph 2: Average quarterly transactions since Q2 2011

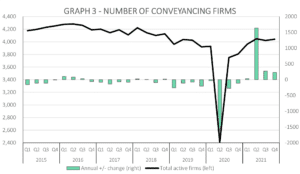

Conveyancing firms rise to the challenge

In terms of market participation, the tracker shows the number of active conveyancing firms in the market followed a similar trend in Q4 to earlier in the year – surpassing the 4,000 threshold for three consecutive quarters. This is the first time this trend has been sustained since 2018, as it was all hands to the pump to keep up with demand at the end of a year of unprecedented property market activity.

A total of 4,041 firms registered completed transactions between October and December, slightly up from 4,021 between July and September. Year-on-year comparisons show that 6% fewer conveyancing firms were active in Q4 2020 compared with the same period this year.

Prior to Q2 2021, the number of active firms per quarter had persistently lagged below 4,000 since Q3 2019, and fell as low as 2,411 during Q2 2020 at the height of the first Covid-19 lockdown when property market activity was heavily restricted.

Graph 3: Number of active conveyancing firms since Q1 2015

Andy Sommerville, Director of Search Acumen, comments:

“Our latest analysis highlights how the property market finished on a high in 2021, with a series of record-breaking milestones landing in the final quarter of the year. Conveyancers and real estate lawyers have had to work extremely hard right until the end of 2021 to manage a sprint finish after a marathon year. We expect 2022 to benefit from the learnings and efficiencies that were forged at the height of the pandemic, to enable savvy firms to enhance their service and keep up with extremely high levels of demand.

“The early months of 2022 demonstrate signs of being slightly less frenetic than 2021. The key market dynamics include global political and economic uncertainty, rising interest rates, higher mortgage rates and a hit to real household incomes caused by inflation and rising living costs. Despite this, we can still expect to see people reassessing their housing needs as the nation crosses its fingers that we have put the worst of the pandemic behind us.

“The coming year still promises to be one of elevated activity and the property market must rise to the challenge. Consumers are increasingly demanding greater transparency and speed when it comes to property transactions, and there will need to be a concerted push to implement the necessary data and digital ways of working that can make this a reality. This will have the longer term result of lightening the burden on already exhausted lawyers – enabling them to process administrative tasks more efficiently and get back to the more rewarding task of advising clients.

“In some cases, technological advancement is being thrust upon the industry by policy changes, as is the case for AP1 submissions, which must be submitted digitally by November 2022. Firms will need to be ready to get ahead of this change, with the risk of bottlenecks in the key due diligence processes emerging if they fail to adequately prepare. But innovation need not be a painful process for property professionals. We expect to see lawyers increasingly proactive at spotting ways to disrupt existing working practices and using technology to create a more seamless transaction process. By making digital the default for the property industry, we can forge a sector that is fit for the future.”