Search Acumen publishes Q3 2022 Conveyancing Market Tracker

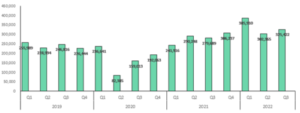

- Average quarterly transaction volumes in Q3 2022 were the highest recorded in five years when discounting Q1 2022, when the administrative backlog from Covid was at its height

- Compared to Q2 2022, completed property transactions were up 8% and remain 32% higher than the same period in 2019

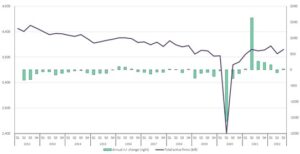

- In contrast, the number of active conveyancing firms has risen far more slowly (less than 1% year-on-year) leading to elevated caseloads

- Over a ten-year period, the number of conveyancing firms supporting the housing market has reduced by more than 10%

- Average conveyancing firms’ quarterly caseload has risen 15% from 70 in Q3 2021, to 80 now, putting extra pressure on transaction timescales

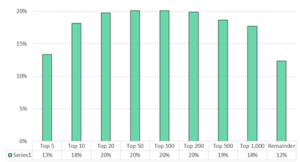

- The top 1,000 firms have seen caseloads rise 18% year-on-year compared with 12% in the rest of the market

- The top 50 firms have increased transactions by 41% from pre-pandemic levels, despite the very biggest firms growing more slowly than the market average. Overall, the largest increases in caseloads are coming from the ‘squeezed middle’ of the conveyancing market, with the largest and smallest firms trailing behind

With recession confirmed and house price falls predicted next year by up to 9% according to last week’s OBR report, property transaction levels remain remarkably high in a race for home movers to complete.

According to the latest edition of the Conveyancing Market Tracker (CMT) from Search Acumen, the property data and technology provider, average quarterly transaction volumes in Q3 2022 were the highest recorded in five years when discounting Q1 2022 which witnessed an unprecedented administrative backlog of lockdown cases completing.

This steady pattern of sales growth can also be seen in an 8% transactional increase from Q2, and a substantial 32% increase from the same period pre-pandemic in 2019.

[Graph 1: Volume of average quarterly property transactions, 2019 to now, showing a sustained period of increase since lockdown]

This meant the average conveyancing firms’ quarterly caseload has risen from 70 in Q3 2021, to 80 in Q3 2022, equating to a significant 15% increase. According to Search Acumen’s analysis, this comes at a time when the market has seen a marginal increase in the number of active firms, rising by just 0.7% in the same period, suggesting that already busy property solicitors are now even busier.

The Market Tracker – which monitors business activity and competitive pressures in the conveyancing market – shows that the volume of active firms in the market is yet to recover to anywhere near the peak of 4,191 in 2017, compared to 4,051 now, and remains 11% down from a decade ago.

[Graph 2: Number of active conveyancing firms and trend of overall decline over the decade]

Andy Sommerville, Director of Search Acumen, explains: “The pressure we are seeing on conveyancing firms up and down the country feels continuous after the peak seen in Q1 of this year following market lockdown, with little respite ever since.

“We know from this data that the size of the conveyancing sector has not kept pace with transactional growth, which inevitably means frustrating delays for consumers and stakeholders alike, especially when you consider the digital switch happening at Land Registry which comes with its own teething issues.

“Mortgage fall-throughs are a big concern as buyers try to beat the tide on increasing interest rates, whilst the three G’s are back in force: gazundering, gazumping, and gazanging. Around 20% of all residential transactions fall-through pre-completion on a normal basis, but the industry is generally accepting that this figure will rise sharply in line with increased market uncertainty. It’s already taking buyers over double the time to get to completion than it did pre-pandemic, and the longer this time is stretched out, the more vulnerable the entire property market is as recession beds in.

He continues: “This comes at a time when the Autumn Statement has confirmed austerity 2.0, where a new focus on public sector efficiency is likely to translate to cutbacks. Less room for investment in key departments that support the real estate markets could see our protracted transactions times get longer. There are significant delays already in processing property transactions and it is hard to see how a cost efficiency drive won’t exacerbate the problem, especially at Land Registry where staff are planning strike action, and for over-stretched local councils.

“This might seem abstract, but delays and transaction failures cause significant blockages, costing businesses, buyers, and sellers huge sums of money at a time when they can least afford it. While the government may be able to support industry by tackling inflation and stabilising interest rates, this will be negated if the market grinds to a halt beneath the surface.”

Smallest and largest firms fall back as the ‘squeezed middle’ grabs conveyancing market share

Search Acumen’s Conveyancing Market Tracker shows there have been winners and losers in a turbulent 12 months for the conveyancing sector. Overall, the UK’s larger firms are continuing to take market share from the rest.

The top 50 law firms have increased their average caseloads by 41% compared to before the pandemic. The top 1,000 firms have grown by 18% in the last 12 months, the top 500 firms have grown by 19%, and the top 200 firms have grown by 20%. This is significantly more than firms outside the top 1,000, which have only increased their caseloads by 12% over the same period. But, at the same time, the very largest firms (top 5), are posting significantly slower growth at around 13%. The nature of the market right now therefore is seeing caseloads increasing most significantly for the ‘squeezed middle’ (top 200 and top 500 firms), while the very largest and very smallest are seeing less rapid growth overall.

[Graph 3: Proportional volume of caseloads and firm growth higher in the ‘squeezed middle’]

Andy Sommerville, Director of Search Acumen, comments: “Mid-sized and larger firms have had the resources to quickly adapt to a growing market, whether that’s been about digitising more services to win new business, processing larger caseloads, or hiring more staff. This competitive advantage must be maintained, however, with further hurdles coming down the tracks as the entire transaction process tries to catch up to the 21st century, starting with the approach of HMLR’s AP1 digitisation deadline at the end of November, no firm can afford to lose momentum.

“Given the pressures of increased caseload volumes as the new normal, and with increasingly complex transactions, longer chains, and greater risks, how each firm fares in the months ahead will be defined by how well it learns the lessons of the pandemic and continues to invest in innovation as a tool for efficiency and cost saving in challenging times.

“We already have technology to digitise property data and automate the transaction process through AI, taking tasks that took weeks, and delivering them in seconds. As Britain’s recession becomes reality, now more than ever the property sector needs to embrace technology to future-proof businesses, keep markets moving, and support everyday buyers and sellers facing significant financial pressures.”

[Graph 4: Average quarterly property transactions dominated by the top 1,000 firms]