- Commercial transaction values in Cambridge increased by 44% in five years, from 2017-2022

- Life Science companies in Cambridge lead the way, with a 108% five-year increase compared to 96% in London and 85% in Oxford

- Major investment deals like the Babraham Research Campus, Cambridge Biomedical Campus, and Westbrook Centre, have fuelled Cambridge’s rise as the UK’s preeminent life sciences hub

Cambridge is leading the charge with the most commercial property transactions within the ‘Golden Triangle’ – the UK’s innovation cluster comprising London, Oxford and Cambridge – seeing a 108% increase in five years, according to latest research from Search Acumen.

The UK’s Golden Triangle has in recent years been used to describe Oxford, Cambridge and London as an arc of locations that are the epicentre of growth of the technology and Life Sciences sectors in the UK. Not only do these cities house some of the most prestigious learning institutions in the world, but they are often cited as the key to propelling the UK’s economic super-power thanks to its globally leading work in biosciences and research.

The research compared commercial property transaction data with the number of businesses registered as part of the sector to demonstrate the correlation between the number of companies in the industry and the take up of space.

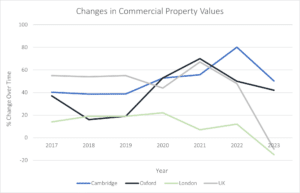

Looking at broader commercial investment trends, whilst commercial transaction volumes are down -20% in Cambridge across a five-year period, values are up by a staggering +44%. This price growth far exceeds Oxford (2%), London (-3%) and across the UK (14%), suggesting a uniquely hot market of high demand and limited supply both compared to its golden triangle opposites, and with the country as a whole.

Table 1: How commercial property transactions compare with each city in the Golden Triangle

| Commercial transaction volumes in 2022 |

Difference from 2021 |

Difference from 2017 (five-year difference) | Average value growth in five years (2022 vs 2017) | |

| Cambridge | 1,235 | -27% | -20% | +44% |

| Oxford | 1,241 | -32% | -22% | +2% |

| London | 19,720 | -27% | -19% | -3% |

Both Oxford and Cambridge were outpacing the increase of commercial property transactions in London pre-pandemic, seeing consistent year-on-year increases as high as 30% in Oxford and 28% in Cambridge, whilst London experienced a more fluctuating market. Mirroring the trend seen across the UK, the pandemic put a halt to the strong growth pattern in commercial property transactions both in Oxford and Cambridge.

Post- pandemic recovery was strong across the innovation arc, buoyed by pent-up demand and limited supply. All three cities saw over a 30% year-on-year increase in volume of commercial transactions from 2020 levels, in which Oxford enjoyed the biggest jump at 36%.

The increased demand in commercial space, such as Labs and research hubs, is reflected in the number of companies registered as active in Companies House records related to the Life Sciences sector. Annual growth for new Life Science businesses in Cambridge peaked last year at 61%. Only one company registered a proposal to strike off (a company indicating their intention to strike off or dissolve), compared to 156 across the UK, suggesting the positive, continued success of the companies that are registered in this location.

Oxford also saw robust growth, with an 84% surge in new life sciences company formations in 2020 amid the pandemic. Whilst not as high as Cambridge and experiencing some inevitable cooling in 2021, Oxford rebounded with a 22% increase in 2022.

London has witnessed a more volatile pattern, with fluctuations in company formations and commercial property activity aligning with pandemic impacts. Whilst the five-year growth in Life Science companies in London sits at 96%. Notably, the total number of liquidations and strike-offs peaked in 2022 and was the highest of the three cities.

Table 2: How the volume of Life Science start-up businesses compares in the Golden Triangle

|

|

Companies House Life Sciences sector registrations in 2023 | Difference from 2022 | Difference from 2019 (five-year difference) | Number of liquidations/proposal to strike off (2023 vs 2019) |

| Cambridge | 50 | +61% | +108% | No change |

| Oxford | 35 | +6% | +84% | -100% |

| London | 108 | +35% | +96% | -50% |

Andrew Lloyd, Managing Director of Search Acumen, says: “Cambridge reigns as King of Commercial, propelled by a melting pot of innovation, research, and technology hubs, with new investors all seeking a slice of the action. A number of key lease agreements for large spaces in the city have contributed to a staggering near 50% growth in values over the last five years, outpacing Oxford, London and the rest of the UK This remarkable upswing underscores the severe supply constraints and skyrocketing demand.”

Commercial growth in Cambridge has been led by several key deals including the building of the 960 Babraham Research Campus, which has 38,000 sq ft of space fully let ahead of practical completion. Other big deals include 85,000 sq ft of shell and core laboratory space at 1000 Discovery Drive, Cambridge Biomedical Campus, along with Cambridge University Hospitals NHS Foundation Trust which in 2023 completed on the remaining available space at the scheme totalling 23,000 sq ft. The Westbrook Centre in the heart of Cambridge was also bought by Reef Group and UBS Asset Management for £75m, with the intention of creating a “a state-of-the-art low carbon life science campus”, further strengthening Cambridge’s leading position as a Life Sciences hub[1]. Furthermore, during the Chancellor’s Spring Budget a further £10 million investment programme was announced to expand the Cambridge Biomedical Campus, with £7.2m promised for transport to the campus[2].

Andrew continues: “The fact that we’re seeing more than double the amount of new Life Science based businesses registering in Cambridge city alone in just five years highlights the significant investment and demand for Life Sciences real estate in these UK clusters, driven by the growth of biotechnology, pharmaceutical, and research companies seeking state-of-the-art facilities. Cambridge is a beacon for investors amid broader economic uncertainty, positively impacting confidence elsewhere. The Oxford-Cambridge Arc is one that continues to deliver, and will continue to do so if urban planners and landowners demonstrate flexibility to accommodate industry expansion.”

In the Spring Budget, the Chancellor reiterated his support of the Golden Triangle as the ‘Silicon Valley of the UK,’ promising £92 million investment in Life Sciences, £100 million investment in artificial intelligence (AI)[3], and £100 million for the AI Life Sciences Accelerator Mission which looks to use health data and AI to address some of the pressures experienced by the sector[4].

[1] Savills – Overview of the Golden Triangle: www.savills.com/research_articles/255800/355132-0

[2] National Health Executive – Life sciences: Spring Budget supports NHS Cambridge growth: www.nationalhealthexecutive.com/articles/life-sciences-spring-budget-supports-nhs-cambridge-growth

[3] Gov.uk – Spring Budget puts UK on fast-track to becoming science and technology superpower: www.gov.uk/government/news/spring-budget-puts-uk-on-fast-track-to-becoming-science-and-technology-superpower

[4] Gov.uk – New £100 million fund to capitalise on AI’s game-changing potential in life sciences and healthcare: www.gov.uk/government/news/new-100-million-fund-to-capitalise-on-ais-game-changing-potential-in-life-sciences-and-healthcare