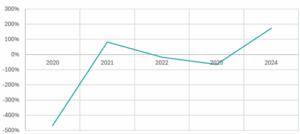

- The gap between the rate of social housing change versus non-working population change is the largest since 2019, widening 173% in a year

- Additional non-working people, or those between 16 and 64 who are economically inactive and often most in need of social care, are outnumbering new social housing numbers 12 to 1

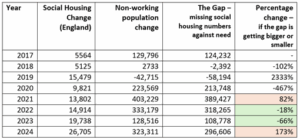

- Gap points to a potential shortfall of 297,00 homes in 2024

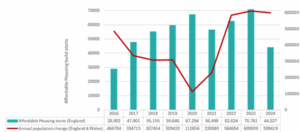

- Build Starts on Affordable Homes declined by 40% in 2024; the largest drop in ten years and the lowest number since records began

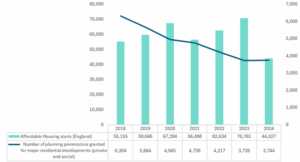

- Planning Permission Granted on large residential developments is also down 40%

- Spending by Local Authorities on Planning & Development Services has dropped by 59% since 2010

- Labour’s recent £39 billion Social and Affordable Homes programme points to an inflection point – industry believe a rapid incline in social housing activity (builds and transaction) is likely over the next 18 months

- Social housing lawyers urged to prepare using technology as firm numbers decline

The gap between the rate of social housing change versus non-working population change is the largest since 2019, widening 173% in a year latest research reveals [Graph 1]. This means that additional non-working people, or those between 16 and 64 who are economically inactive and often most in need of social care, are outnumbering new social housing numbers 12 to 1.

The research conducted by property and legal data firm, Search Acumen, suggests that the widening gap points to England’s growing housing deficit, with a potential shortfall of 296,606 affordable and social homes in 2024 against a growing need [Table 1].

As well as outpacing new housing, data shows that the rise in economically inactive individuals has been nearly 10 times greater than the increase in the working-age population since 2019.

Whilst the data available on social housing focuses on England against a broader UK population comparison, Search Acumen says the research is indicative of wider concerning trends of the housing crisis faced by the current government.

Graph 1: Mind the Gap: Social housing need is outpacing delivery. Graph shows the gap between the rate of social housing change versus non-working population change, in which the increasing gap points to a growing housing deficit, widening 173% in a year.

*Source: Search Acumen analysis of Ministry of Housing, Communities and Local Government data and Labour Force Survey from the Office for National Statistics.

Table 1: The difference between the annual change in the UK’s non-working population against the count of new additional social housing being delivered in England. Note change figures are cumulative, rolling on to the next year.

*Source: Search Acumen’s analysis of Ministry of Housing, Communities and Local Government data and Labour Force Survey from the Office for National Statistics.

Search Acumen’s analysis shows that 2023 recorded the highest yearly rise in population growth in over 75 years, against a marked decline in Affordable Home build starts. Dropping by nearly 40% in 2024 (-37.8%), this is the largest drop in ten years and the lowest number of build starts since 2015 when records began [Graph 3].

Examining the data in detail, the number of starts in London decreased by 88% between 2022 and 2024, in which the number of London Affordable Rent starts sat at just nine units. This decline is led by the end of the 2016-23 Affordable Homes programme that was the main funding source for this tenure.

Andrew Lloyd, Managing Director of Search Acumen, comments: “Our research looks at trends as to whether we are building enough homes fast enough. We know the answer of this to be no, but what is troubling is just how far behind we really are. In England, there were approximately 4.5 million social homes, down from 5.5 million in 1979 thanks to long-term losses in demolitions, conversions, and inadequate rebuilding. Looking at social rent alone, over the past decade there was a net loss of 177,500 homes in England, meanwhile the waiting list climbed to 1.33 million households last year up 10% since 2022. Forecasts suggest this could rise to 2 million households by 2034 if social homebuilding stays unchanged. With a growing base of people not working, the mismatch between supply and demand is acute.”

“For the current government, closing this gap will be hard, but Labour is keen to prove themselves and show results within their electoral term. There is hope things will change, but the complex economic backdrop of tighter margins, inflated costs and skill pressures on housebuilders weigh heavy against social need.”

Graph 2. Affordable Housing Starts against general UK population change year-on-year.

*Source: Search Acumen’s analysis of Ministry of Housing, Communities and Local Government data and Labour Force Survey from the Office for National Statistics.

Furthermore, the number of Planning Permissions Granted for major residential developments in England – those that often include a proportion of new affordable homes as part of the Section 106 agreement – are nearly half that of peaks seen in 2016, 2017 and 2018 [-41% decline], according to Search Acumen’s findings [Graph 3].

Combined, the need for housing providers to navigate issues around profitability and private demand have never been more acute, says Andrew.

“I believe this is an inflection point for the sector. Post-war we saw government funded Local Authorities creating a housing boom – something we are about to see again under Labour, driven by social need not private enterprise.”

The government’s £39 billion Social and Affordable Homes programme announced earlier this year will be a much-needed raft for many providers in the next 18 months.

He explains, “Whilst the working population rate is declining against a general ageing population that is demanding more of social care, it begs the question: where will people live. As the commercial viability of building large scale developments is coming under more and more scrutiny with the end of Help-to-Buy and ever-tightening profit margins, the social housing need must be met instead by the public sector. Whilst it is socially responsible to build affordable homes, it may not be profitable – this means the government have a duty to act with more funded schemes likely to fill the void.”

Graph 3. Demonstrating declining volume of planning permissions granted for major residential applications and declining Affordable Housing starts.

*Source: Search Acumen’s analysis of Ministry of Housing, Communities and Local Government data.

Andrew predicts a social housing boom that could trickle through to government data sets by next year. He urges property lawyers to brace themselves for a wave of demand in Q4 of 2025 from HAs, LAs and other registered providers.

Real-term spending per person by Local Authorities on Planning & Development Services has dropped by 59% since 2010 according to the IFS, which means the sector will rely heavily on technology to fill the skills and resource gap, looking to build in efficiencies wherever possible.

Andrew explains, “Lawyers on both side of the transaction must use technology to plug the gap, there is no doubt about it. To work on social housing caseloads means high volume and low margins, where AI tools become business critical for lawyers to win at tender. Simply put, technology is the only way we are going to be able to deliver any large quantity of houses at pace and within the current government.”