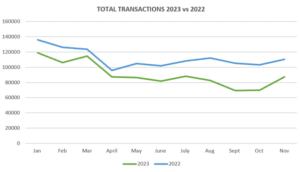

- The average property law firm is now handling 25% fewer cases a year ago, following a 21% fall in monthly property transactions year-on-year.

- The top 500 property law firms registered a 60% market share for 2023, a record high.

- September 2023 saw the fewest property transactions in nearly three years.

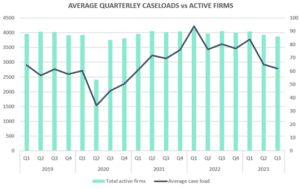

- The average property law firm handled 62 cases in Q3 2023, compared to 84 in Q1 2023 and 94 at its peak in Q1 2022.

- The number of active property law firms dropped below 3,900 for the first time (outside of a pandemic) in August 2023 and has remained there ever since

The sluggish property market has had a lacklustre effect on property lawyers, who are now handling 25% fewer cases on average following a 21% fall in monthly property transactions year-on-year[1].

According to the Conveyancing Market Tracker (CMT) from property data company Search Acumen, the average property law firm handled 62 cases in Q3 2023, a 25% decrease year-on year and a 41% decrease from its Q1 2022 peak where firms handled an average of 94 cases per quarter in the post-pandemic frenzy.

The decline reflects a fall in monthly transactions, in which latest data recorded a 21% fall year-on-year. Likewise, September 2023 recorded the fewest property market transactions in nearly three years, in line with figures seen during lockdown[2].

However, 62 cases per quarter is in line with pre-pandemic figures, being on par with the quarterly average from 2019 volumes, which could be an indication of a return to traditional activity levels.

Search Acumen’s analysis also shows the total number of active firms has suffered from the market slowdown, dropping below 3,900 for the first time outside of a pandemic in August 2023 and remaining below that level ever since.

This reflects a market rife with acquisitions and big winners, according to Search Acumen. The top 500 law firms are on track for a 60% market share for 2023, which would be a record high up from 51% in 2011, now handling three in five transactions.

Similarly, the top 100 has edged their market share up to around 77%, which is another record high on an annual basis, up from 65% in 2011.

Andy Sommerville, Director at Search Acumen, says: “As workloads slow for property lawyers, a number of firms are making moves to consolidate in a sign of the changing demands of the real estate market. During periods of significant mergers and acquisitions, it is therefore likely that some of the larger firms may be growing due to this, and why the top 500 firms are dominating market share.”

In a recent study[3], 95% of firms found that implementing technology has made them more responsive to client needs, 72% of firms use tech to improve service quality, and 71% of firms working with large corporate clients use technology to help them deliver services to improve margins.

Furthermore, interest in using AI as a complimentary tool for admin and data efficiency is growing. More than one in four (28%[4]) of the top 100 firms have invested in Robotic Process Automation, according to data from Lexis Nexis.

Andy continues: “We know a slowdown in commercial and residential property instructions is having a particular effect on caseload volumes, where the fight to win an instruction from competitors has been sharply brought into focus. The data backs up what we know anecdotally, that the adoption of technology in the legal sector is increasing at pace, allowing bigger firms to maintain a competitive advantage.

“With rapid advancement in what technology can deliver for businesses’ bottom lines, the use of tools like AI to drive efficiencies is no longer a nice-to-have, but crucial in the race against obsolescence. Staying relevant to clients has to be critical to conveyancers at a time of market crunch.”

[Graph 1: total transactions down 25% year-on-year comparing 2023 to 2022]

[Graph 2: Average quarterly caseloads have declined 25% year-on-year, whilst total active property law firms have decreased in volume by 4% across the same period]

[1] Year-on-year reflects Jan to Nov 2022 vs Jan to Nov 203. AT the time of analysis, December 2023’s data was not released from HMLR.

[2] September 2023 recorded 69368 total transactions according Search Acumen analysis of HMLR data, the lowest level since November 2020 where 57632 transactions were recorded.

[3] Percentage of law firms using third-party IT and technology support

[4] 50-legal-technology-stats-you-need-to-know-for-2022

Methodology

The Conveyancing Market Tracker examines competition in conveyancing by analysing business activity among those firms holding HM Land Registry client accounts, as well as assessing commercial pressures and the outlook among conveyancers. The Tracker was designed by Instinctif Partners. While care is taken in its compilation, no representation or assurances are made as to its accuracy or completeness.